- April 8, 2025

2025 Stock Market Crash: What Investors Need to Know Now

The 2025 stock market crash is no longer a rumor—it’s rapidly becoming a reality that is reshaping portfolios around the world. With 2025 market volatility at a decade high and warning signs blinking across major indices, investors are bracing for impact. Whether you’re a seasoned pro or a newcomer trying to navigate this chaos, understanding the 2025 stock market crash could be the defining factor in preserving your financial future.

What’s Fueling the 2025 Stock Market Crash?

The global economy is caught in a cinematic sequence of high-stakes tension and unpredictable turns. The key factors pushing the market into this spiral include:

- Federal Reserve Policies 2025: Aggressive interest rate hikes to combat inflation have frozen lending activity and slowed down consumer spending, hitting business revenues hard.

- Global trade tensions 2025: Political unrest and economic sanctions have disrupted cross-border commerce, impacting exports and choking supply chains.

- Tariffs’ impact on markets 2025: Renewed tariffs between major economies like the US and China are weakening global trade flows and hurting emerging markets.

- Investor sentiment 2025: Fear is dominating logic as panic selling drives markets lower, further fueled by negative media narratives.

- Economic Indicators 2025: Declining GDP growth, rising unemployment, and manufacturing slowdowns have signaled that the economic engine is sputtering.

According to The Economic Times, this isn’t just a typical correction—it’s a structural shake-up that could echo the financial crises of the past but with a 2025 twist.

The Red Flags: How to Spot a Market in Trouble

If you’re watching the market closely, you’re likely noticing patterns that scream “danger ahead.” Let’s unpack some of them:

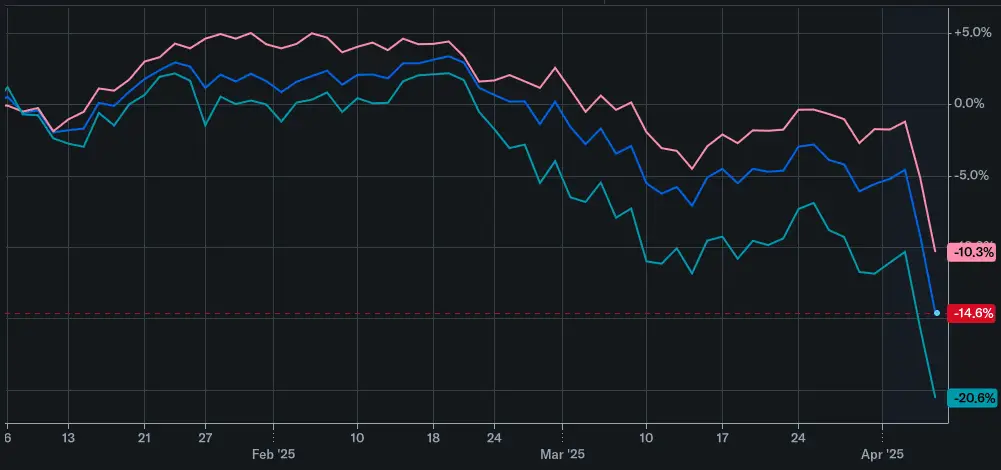

- The S&P 500 and Nasdaq have dipped more than 20% YTD, officially entering bear market territory.

- Big Tech stocks, once seen as safe havens, are leading the decline due to overvaluation and shrinking margins.

- Corporate debt defaults are on the rise, especially in the real estate and fintech sectors.

- The VIX (Volatility Index) is hitting levels not seen since the pandemic crash.

- Companies are slashing earnings guidance, a clear indicator that they’re expecting tougher quarters ahead.

These aren’t isolated incidents. Financial experts from MarketWatch and Finblog – Empowering Financial Literacy confirm these are strong market correction signs 2025 investors should take seriously.

A Cinematic Crisis—Or the Start of a New Chapter?

Every generation has its financial turning point—2000’s dot-com bust, 2008’s housing collapse—and now, the 2025 stock market crash. It’s playing out like a high-budget thriller: CEOs resigning mid-quarter, governments rushing to deploy fiscal stimulus, and financial institutions adjusting risk models overnight.

This isn’t just a drop in prices—it’s a reset. A massive one. As told by leading voices in Financial Market Analysis 2025, this crash is not just about numbers, but about psychology. The story of this downturn is being written in real-time, by investor emotion, media pressure, and central bank policies.

How to Protect Yourself: Investment Strategies During Downturns

During crises, wealth isn’t just lost—it’s transferred. Smart investors see downturns as strategic entry points. Here’s how to armor your finances during the storm:

- Rebalance your portfolio: Prioritize recession-proof sectors like healthcare, utilities, and consumer staples.

- Hold cash or cash equivalents: Liquidity is king during crashes. It allows you to buy the dip without borrowing.

- Focus on dividends: Look for strong companies that continue paying dividends during downturns—they provide steady returns when growth is frozen.

- Reduce international exposure: Global uncertainty is higher than ever, making local defensive assets a better short-term play.

- Seek out undervalued blue-chip stocks: Legendary investors made fortunes buying quality stocks when they were on sale.

- Leverage financial tools: Use stop-loss orders and portfolio trackers to avoid emotional decision-making.

Frequently Asked Questions

Is this the worst crash in recent history?

While 2008 was deeper in some ways, 2025’s crash is broader—spanning global economies, and sectors, and affecting modern assets like crypto and tech-heavy ETFs. Experts from The Economic Times suggest it’s still unfolding.

Should I sell everything and move to cash?

Not necessarily. Strategic rotation is better than panic selling. Keep what’s stable, cut what’s bleeding, and preserve capital to re-invest.

What about retirement funds?

If you’re not retiring soon, avoid drastic changes. Stick to long-term strategies. But if you’re within 5 years of retirement, talk to a certified planner ASAP.

Are we heading into a recession?

All signs point toward a recession in late 2025 or early 2026, driven by consumer slowdown and tight fiscal policies.

Closing Thoughts: Turning Crisis into Strategy

The 2025 stock market crash is dramatic, yes—but it also marks the beginning of something new. Out of every crash comes rebirth. For those with a plan, the downturn isn’t destruction—it’s recalibration. Use insights from Finblog – Empowering Financial Literacy, stay informed via MarketWatch, and remember: timing the market is nearly impossible, but preparing for volatility is a choice.

This isn’t the end. It’s the prologue to a smarter investing era—if you’re ready to write your role.