- November 2, 2023

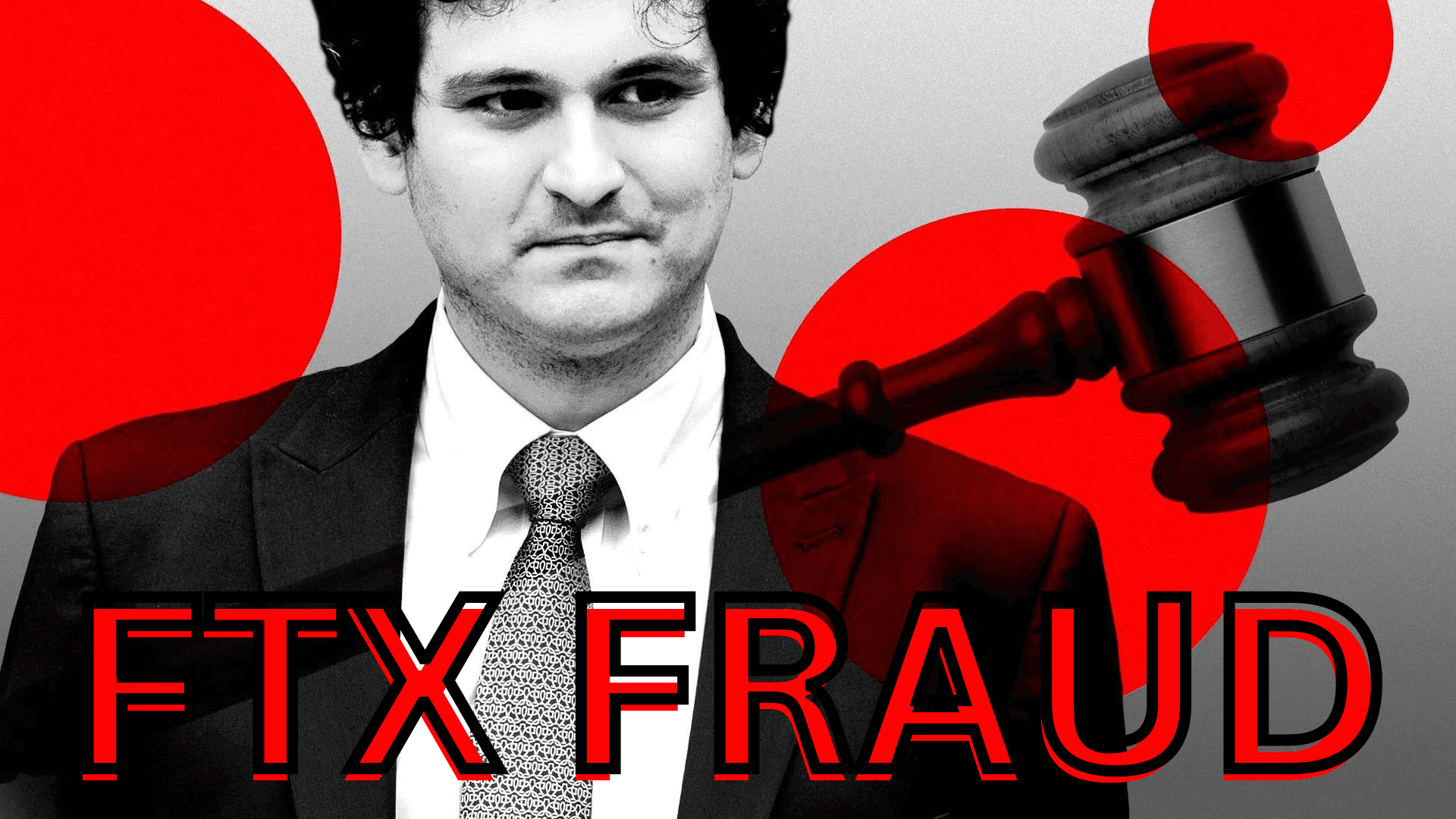

‘Crypto King’ Sam Bankman-Fried Guilty Of FTX Fraud

FTX fraud by Sam Bankman-Fried

Sam Bankman-Fried, once at the helm of one of the world’s largest cryptocurrency exchanges, has been convicted of fraud and money laundering following a month-long trial in New York. The jury reached its verdict in under five hours, marking a significant downfall for the 31-year-old former billionaire and a prominent figure in the crypto industry.

Bankman-Fried’s legal troubles began when his firm, FTX, faced bankruptcy, leading to his arrest last year. The upcoming sentencing, scheduled for March 28 next year, could result in him spending decades in prison.

US Attorney Damian Williams characterized Bankman-Fried’s actions as “one of the biggest financial frauds in American history,” aimed at establishing his dominance in the cryptocurrency realm. The prosecution alleged that Bankman-Fried had deceived investors and lenders, embezzling billions of dollars from FTX, which contributed to the exchange’s collapse. He faced seven counts of fraud and money laundering.

Despite his plea of not guilty and assertions that his actions were made in good faith, the jury’s verdict came down against him. Following the verdict, Bankman-Fried’s lawyer, Mark Cohen, expressed respect for the jury’s decision but conveyed disappointment with the outcome. He added that Bankman-Fried maintains his innocence and plans to vigorously challenge the charges.

Notably, three of Bankman-Fried’s close associates, including his ex-girlfriend Caroline Ellison, had pleaded guilty and agreed to testify against him in the hope of receiving reduced sentences. Their sentencing is pending.

The prosecution’s case revealed that Bankman-Fried’s crypto trading firm, Alameda Research, had received deposits on behalf of FTX customers when traditional banks had refused to open accounts for the exchange. Instead of safeguarding these funds, as he had publicly promised, Bankman-Fried diverted the money to repay Alameda lenders, invest in property, and make political contributions.

Bankman-Fried was found guilty of five charges carrying a maximum prison term of 20 years, along with two charges carrying a maximum of five years each. While it is improbable that he will receive the full 110-year maximum sentence, he is expected to face a sentence spanning decades.

When FTX faced bankruptcy in November of last year, Alameda found itself owing a substantial $8 billion (£6.5 billion) to the company. In the closing arguments of the trial, Assistant US Attorney Nicolas Roos stated, “He took the money. He knew it was wrong. He did it anyway, because he thought he was smarter and better and that he could figure his way out of it.”

In an attempt to demonstrate his innocence, Bankman-Fried took the witness stand, aiming to persuade jurors that the prosecution had not successfully proven his criminal intent. His defense argued that while there were lapses in judgment, his actions did not amount to criminal wrongdoing. His lawyer, Mr. Cohen, portrayed Bankman-Fried as a math-oriented individual who became overwhelmed as his companies rapidly expanded.

Bankman-Fried justified the money transfers between his firms as “permissible” and asserted that he was largely unaware of the financial crisis described by his subordinates until a few weeks before FTX’s collapse last year. This collapse had severe consequences, leaving many customers unable to recover their funds.

However, in a positive turn, lawyers involved in the bankruptcy case have reported that they have managed to recover the majority of the missing funds.

Also Read: Dubai Metro Blue Line Expansion: A Journey Underground