- May 7, 2025

Fed Meeting Today: The Fed’s Key Rate Announcement Creates Market Effects

The Federal Open Market Committee meeting draws worldwide market attention since stakeholders worldwide await the Federal Reserve’s current policy direction. The Fed meeting today keeps global markets on edge because its decisions about interest rates and inflation measurements will reshape stock market values while altering currency market dynamics.

Federal Reserve Meeting Today: What You Need to Know

The Federal Open Market Committee (FOMC) gathered together today to determine the trajectory of U.S. monetary policy. The Federal Reserve maintains a fragile position between advancing economic growth and protecting against renewed inflationary pressures despite recent cooling signs and strong labor markets.

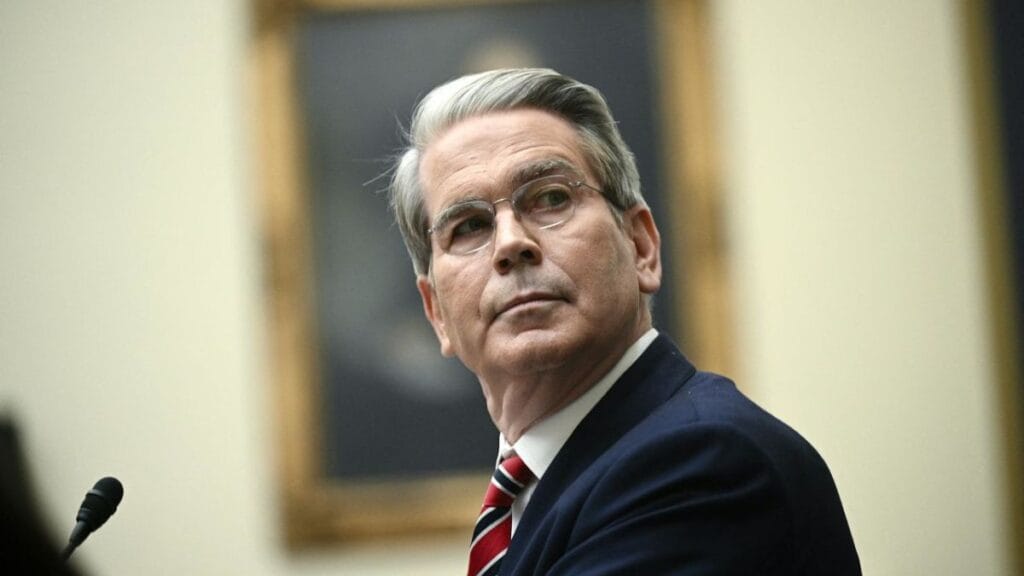

Chair of the Federal Reserve Jerome Powell stated that the Fed Meeting Today needs to approach its decisions using analytical data alongside an intentionally paced approach. The committee showed market consensus by keeping the current federal funds rate unmodified during today’s voting session. Powell’s statement tone has invited criticism because it indicates that the Fed keeps the option open for future rate tightening in case inflation rises again.

FOMC Decision Today: Market and Economic Implications

- No Change in Rates: The Fed Meeting Today maintained its current interest rates per market expectations. The banking institution now has additional time to track inflation patterns as well as overall economic data metrics.

- Inflation Still a Concern: Despite the improved inflation figures, the Federal Reserve shows increased caution regarding monetary policy. The combination of flexible pricing practices in the services sector and rising employee wages continues to stress federal policy decisions.

- Economic Growth Outlook: The Fed has optimism about avoiding a recession but conditions like increasing household debt and global tensions prevent the central bank from boosting its growth forecast.

Jerome Powell Announcement: Investor Sentiment and Strategy

Today’s Federal Reserve chair used a thoughtful, positive approach in their presentation. In his remarks, Powell stated inflation has shown better results but remains above the Federal Reserve’s desired 2% target. Market volatility ensued following investors’ adjustments toward slated Fed rate reduction possibilities during the second half of 2025.

- The Fed’s policy meeting produces immediate movements within stock market prices.

- The market started its day with substantial optimism, but the Federal Reserve’s statement triggered immediate movements throughout market sectors.

- Tech and Growth Stocks: Major stocks that were the Fed rate-sensitive markers experienced upward movement due to the confirmation ofa potential rate hike suspension.

- Banking Sector: Market stability prevailed because interest rates on short-term borrowings showed no indication of change.

- Real Estate and Homebuilders: The market responded positively to indications that mortgage rate pressure is set to decrease slightly.

Bond Yields After Fed Decision

The U.S. Treasury yields registered a minor decrease when market traders analyzed the Fed Meeting Today announcement, implying a less aggressive monetary policy direction for forthcoming periods. Market analysts reported a slight reduction in the 10-year yield because expectations for future long-term interest rates dropped. Equity and fixed-income investments tend to perform better when yield levels fall.

USD Movement Post-Fed Announcement

The U.S. Dollar saw an initial price rise that ultimately returned to starting levels following the announcement. Powell’s statement led foreign exchange market participants to see his stance as neutral between hawkish and dovish stances. Future readings of employment data, together with inflation statistics, will shape the greenback’s exchange rate direction.

Market analysts observed that gold prices reacted to the Federal Reserve’s policy outlook

After the Fed’s statement, the monetary metal demonstrated marginal price appreciation because interest rates in real value retained stability. The financial market recognizes gold as a security instrument against both mistaken economic policies and unforeseen inflation volatility. Gold holds its appeal in uncertain periods because the Federal Reserve failed to schedule a rate cut deadline.

Investor Sentiment on Fed Rates

Market sentiment remains mixed. Both equity market enthusiasts expect upcoming rate cuts while fixed-income investors maintain reserved positions. Market analysts predict the Federal Reserve will keep rates unchanged until significant inflation or employment figures change.

Economic Outlook Post-Fed Meeting

Consumer Spending:

Consumer spending rates will reduce because people are adjusting to both increased debt burdens along ongoing price instability.

Business Investment:

Businesses plan to keep their investments toned down because borrowing expenses stay high while future business planning faces uncertainties.

Labor Market:

The employment market continues to deliver robust performance yet wage increases along with job openings data weaken—this dual trend will affect the Fed’s upcoming policy direction.

Analyst Predictions on Fed Policy

- Research analysts now speculate that the Federal Reserve will make its initial rate reduction in Q4 of 2025.

- According to some investors, inflation must decrease to acceptable levels before the Fed Meeting Today, officials would consider interest rate reductions.

- Rate cuts remain uncertain for 2026 because a small number of experts predict inflation will resist reduction over a long time.

Market Volatility and Fed Decisions

Market volatility rises during Federal Reserve meetings as demonstrated again today. The market values moved throughout the day before stabilizing. Financial traders must be prepared for additional market swings throughout the rest of this week when they analyze economic reports and decode Federal Reserve statements.

Live Insights: Fed Meeting Today Press Conference Highlights

- In his remarks, Powell emphasized how the Federal Reserve monitors both spending stability and workforce employment levels.

- The Federal Reserve did not indicate any firm policy decisions regarding future money supply adjustments.

- Some positive traders felt let down when officials did not guarantee a summer rate reduction during the Fed Meeting Today.

Wall Street Reaction: Fed Decision Moves Markets

The financial markets are changing their investment strategies according to today’s assessment of the Federal Reserve’s direction. The market reacted by favoring defensive sectors alongside utility companies while growth-oriented speculative stocks produced variable outcomes. The markets await inflation results along with Chairman Powell’s statements to determine their future trajectory.

Conclusion: Today’s Federal Reserve Meeting Demonstrates a Calm Reaction Instead of Panicked Decisions

Fed Meeting Today revealed the central bank’s methodical steps toward managing economic instability. The Fed shows a willingness to keep waiting without significant policy changes. Market actors must maintain careful approaches by maintaining strict data orientation. The Fed’s next decision will either stabilize markets or create significant movement based on upcoming economic indicators.